Click on the map to begin your search

What is a Short Sale?

In real estate, the term "short sale" refers to the situation when a homeowner sells their property for much less than the amount they owe on their mortgage.

This happens when the homeowner finds himself in financial distress.

The property is sold to a third party, and all the proceeds from the sale are handed to the lender. In such arrangements, the seller of the house does not receive enough money from the sale to pay off the rest of the mortgage, and this difference must be met somehow.

If a person sells his home for $150,000, but still owes $175,000 on the mortgage, the difference between these values is the deficiency.

The lender may either forget this difference or get a deficiency judgment against the borrower. This deficiency judgment ensures that the borrower pays the lender the difference between the selling price and the original value of the mortgage.

However, in most states, this difference is legally required to be forgiven in the case of a short sale.

Before this process begins, the lender (which is usually a bank) who holds the mortgage must approve the decision of making a short sale.

This is known as the "pre-foreclosure"

Documents are required by the bank to explain why a short sale is the only option left for the borrower so that they can approve this sale. After all, they have a lot of money tied up as well.

A short sale may not seem the ideal scenario for a homeowner, but it is sometimes the best option for people unable to secure their mortgage. The process may be long and intensive, but short sales are often better options than a property foreclosure.

Short Sale Process

Although strategic short sales are possible, most of the time lenders will require a borrower to show some means of financial hardship in order to qualify for a short sale. In order to be eligible, borrowers must submit a detailed short sale application with their lender.

Banks and lenders actually have whole departments dedicated to dealing with short sales where they will assess the value of your home, usually through an appraisal, and evaluate the terms and the sale of the property. They are the ones who will decide if your home can be approved for a short sale or not.

Buyers should expect to wait a long time for a response from the bank. It's important for the short sales listings agent to constantly call the bank and check up on the status of the application. You'll need to have a lot of patience when dealing with a short sale since the process can take anywhere from 30 days to a few months.

Lastly, be prepared to fight with the mitigation department at the bank for the closing price of the home.

They'll often try to get as much money out of you as possible but once that's settled on, the package will be sent to final approval. It's here that the home is allowed to continue on unfettered and the sale can be completed.

Short Sale vs. Foreclosure

For sellers, foreclosure should try and be avoided at all costs, often a deed in lieu of foreclosure or a short sale are much better options.

The foreclosure process is usually initiated after 90 days of missed payments. With a short sale, that's not always the case since you can actually be approved for a short sale without ever defaulting on payments.

Each situation is unique so you'll have to look at all the facts and see which option is better for you.

In a short sale, you are effectively in control, since you set the listing price and agree on the final terms with the bank. With a foreclosure, you stop making payments and walk away from the home.

The former will only affect your credit for 3 years and you can even buy another home within a year or two as long as you follow certain FHA guidelines.

With a foreclosure, you will see derogatory marks on your credit report and you won't be able to buy another home for 7 years.

As a property owner, it's generally best to try and exhaust all methods of short sale before resorting to a foreclosure.

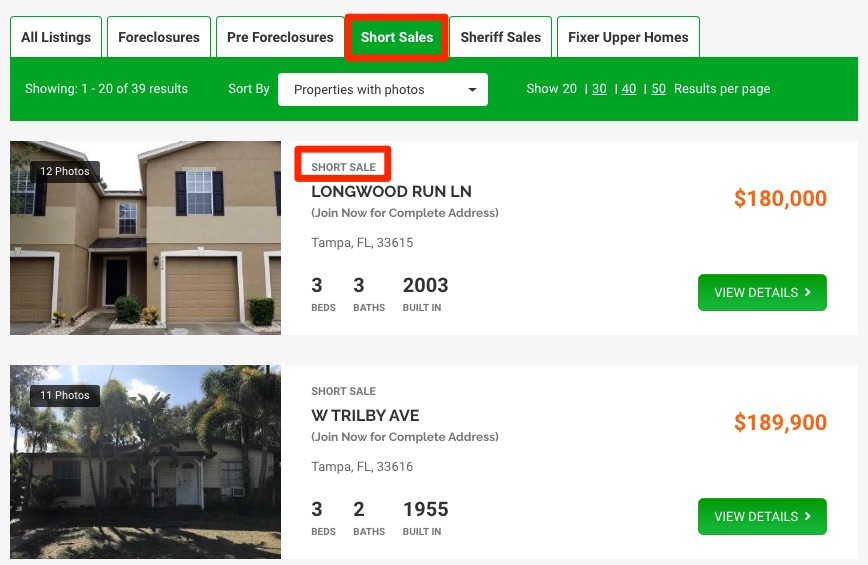

How to Find Short Sale Homes

Like with any real estate purchase, you'll want to find an experienced realtor who has dealt with many short sales in the past. They will be able to help you find the best deals on short sales in your desired area.

You can also scour the internet listings yourself to find great deals on short sales.

One easy way to tell if a property is a short sale or not is to look at the most recent sales price of the property. If it's higher than the listing price, the property is most likely a short sale.

Buying a Short Sale Home

Buying a short sale home can be a great way to invest in a property at a discount. Although the process can take a bit longer than a traditional sale, the bargain price easily makes up for the lost time.

As a buyer, make sure that you enlist the services of a realtor with short sale experience. You can't control the experience level of the listing agent, but you can ensure that your agent is battle tested and knows exactly what needs to be done.

After the seller accepts your offer, the short sale package will be sent to the lender and they must also approve the sales price.

You do not have a deal until this happens.

The lender will also want to see that you are pre-approved for a loan and have adequate financing and a suitable down-payment in order to qualify for the property in question.

Lastly, make sure that you reserve the right to a thorough inspection. Since lenders are losing money on short sales, they will generally try to avoid paying for any repairs or problems found during an inspection.

The Pros of a Short Sale:

- Short sales will not impact your credit as negatively as a foreclosure might.

- Many states do not allow a deficiency judgment. It means that you may not have to pay a fee for not meeting the terms of your mortgage.

- You also have the option of convincing the lender to waive off this fee.

- You are in control of how much you sell your home for and to whom you want to sell the house after getting approval from the lender.

The Cons of a Short Sale:

- Your credit scores will be negatively affected.

- There is no guarantee that you will find an appropriate buyer for your property or that the lender will approve the short sale.

- In some cases, you will be required to pay the deficiency judgment.

- Even if the lender waives off the deficiency amount, you may still have to incur a large tax bill.

The Impact on Your Credit Scores

An important factor that impacts the homeowner's decision is the impact of a short sale on their credit scores.

There is no doubt that you will have to face a blow to your credit score.

It can drop as much as 100-150 points, depending on what it was initially. The greater your credit score, the bigger hit you will take.

The average credit score of a homeowner falls in the range of 300 to 850. For those whose score lies in the 750-800 range, a drop of 150 points can be caused by a short sale.

If you have a credit score in the 650-720 range, a loss of 100 points can occur due to the short sale. This may plunge you into the subprime category.

A lower credit score can make it difficult for you to secure another mortgage or borrow a loan.

Even if you are eligible for borrowing, the rate of interest offered to you will be remarkably high.

Rebounding from a Short Sale

Although both short sales and foreclosures do not sound that appealing, if you find a way to continue making your outstanding mortgage payments until closing a short sale, you might find an early rebound from the damaging process.

You will likely be able to get a new mortgage on another home in only two years or even lesser time if you continue paying off the mortgage until the sale is made. In the case of a foreclosure, this can take 5 to 7 years! The silver lining is that you can start to improve your credit score by taking some proactive steps.

Therefore, you should focus more on your consumer credit by always paying your bills on time and keeping your credit card balance low. Pay your debts as soon as possible or obtain a secured credit card to enhance your creditworthiness for the future.

How soon can you rebound from a short sale credit hit?

You are likely to rebound from the falling credit score in just two years after the short sale has closed if you continue paying off the mortgage until the sale is completed.

What is a deficiency judgment?

It is the difference between the selling price of the house and the amount of mortgage that is still owed on it. In a short sale, the property is sold at a selling price that is lower than the amount owed on the mortgage, hence the name "short" sale.